Debt Consolidation Loans for the Self-Employed provide a solution for freelancers managing multiple debts, offering flexible repayment options and lower interest rates. While challenging for those with bad credit due to lack of traditional verification, preparing financial documentation and showcasing responsible borrowing habits can improve loan eligibility. Lenders carefully assess income stability and credit history, requiring tax returns and bank records. Understanding repayment terms—fixed or variable rates, shorter vs longer durations—empowers borrowers. Specialized lenders cater to self-employed individuals' needs, considering alternative credit references. Enhancing creditworthiness through budgeting, responsible payments, and prioritizing high-interest debt increases chances of securing favorable loan conditions.

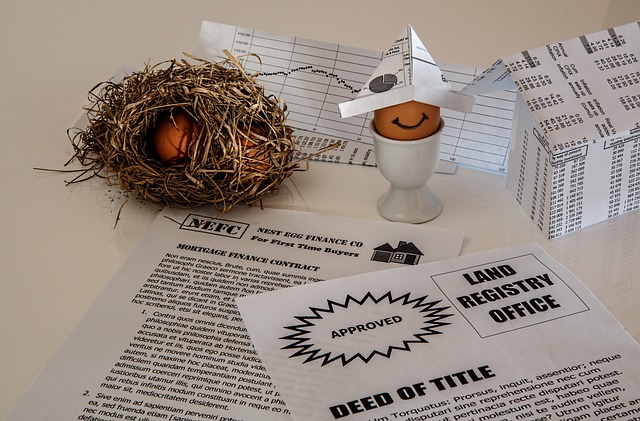

Looking to consolidate debt despite a less-than-perfect credit history? Unsecured consolidation loans offer a potential solution. This article guides you through the process, focusing on debt consolidation loans for the self-employed. We explore the advantages these loans provide, from improved cash flow to simplified repayments. Learn how to assess your creditworthiness, understand repayment terms, and find lenders catering to bad credit histories. Additionally, discover strategies to enhance your credit score before applying.

- Understanding Unsecured Consolidation Loans

- The Benefits for Self-Employed Individuals

- Assessing Your Creditworthiness for Loan Approval

- Exploring Repayment Options and Terms

- Finding Lenders Specializing in Bad Credit History

- Strategies to Improve Your Credit Before Applying

Understanding Unsecured Consolidation Loans

Unsecured consolidation loans are a popular option for individuals looking to streamline multiple debts into one manageable repayment. Unlike secured loans that require collateral, unsecured loans rely on the borrower’s creditworthiness and repayment history. For those with bad credit, this can be a game-changer as it provides an opportunity to access funding without putting up assets at risk. Debt consolidation loans for the self-employed are particularly tailored to meet their unique financial needs, allowing them to consolidate business debts or combine personal and business expenses into a single loan with potentially lower interest rates and more flexible terms.

This type of loan enables borrowers to simplify their financial obligations by consolidating various debts like credit cards, personal loans, and even some types of medical bills. With one loan, individuals can reduce the number of monthly payments they need to make, making it easier to stay on top of repayments and potentially save money in interest charges over time. It’s important to note that while unsecured consolidation loans offer flexibility, lenders will carefully evaluate an applicant’s financial situation and credit history, which can be challenging for those with bad credit due to the higher risk associated with lending without collateral.

The Benefits for Self-Employed Individuals

For self-employed individuals grappling with debt, debt consolidation loans for the self-employed offer a beacon of hope. These specialized loans are designed to address the unique financial challenges faced by freelancers and small business owners. Unlike traditional loans that often require collateral or strict credit checks, these consolidation loans provide a more flexible and accessible path to financial relief.

One of the key benefits is the potential for lower interest rates, which can significantly reduce the overall cost of debt repayment. This is particularly advantageous for self-employed individuals who might have irregular cash flow or uneven business cycles. By consolidating multiple debts into one loan with a lower interest rate, these professionals can streamline their financial obligations and regain control over their finances.

Assessing Your Creditworthiness for Loan Approval

When applying for unsecured consolidation loans, especially as a self-employed individual, lenders will carefully assess your creditworthiness to determine loan approval and terms. This involves evaluating your financial health through various factors like income stability, debt-to-income ratio, and overall credit history. Since self-employment may not provide the traditional employment verification, it’s crucial to demonstrate consistent cash flow and a solid business standing. Lenders often require tax returns, business financial statements, and bank records to gauge your financial responsibility.

A positive credit history, even with occasional setbacks, can still increase your chances of securing favorable loan terms. Lenders look for signs of responsible borrowing, such as timely payments on existing debts or successful debt management plans in the past. Self-employed borrowers should be prepared to showcase their ability to manage finances effectively and make consistent repayments to enhance their creditworthiness and secure Debt Consolidation Loans tailored to their needs.

Exploring Repayment Options and Terms

When considering debt consolidation loans for the self-employed with bad credit history, understanding your repayment options and terms is crucial. Many lenders offer flexible plans tailored to fit individual needs, allowing borrowers to choose between fixed or variable interest rates, and repayment periods ranging from 3 to 10 years. This flexibility ensures that you can select a plan that aligns with your financial goals and capabilities.

Fixed-rate loans provide stability by keeping monthly payments consistent throughout the loan term, while variable-rate loans offer lower initial interest rates but may fluctuate over time. Repayment periods also vary, with shorter terms resulting in higher monthly payments but less interest paid overall, and longer terms offering more affordable monthly installments but accumulating more interest charges. Exploring these options allows borrowers to make an informed decision that best suits their unique financial circumstances.

Finding Lenders Specializing in Bad Credit History

When it comes to debt consolidation loans for individuals with a bad credit history, finding lenders who specialize in this area is crucial. Many traditional banks and financial institutions may be reluctant to offer such loans due to the higher risk associated with poor creditworthiness. However, there are dedicated lenders and credit unions that cater specifically to those in this situation. These specialists understand the challenges faced by the self-employed or individuals with irregular income patterns, which often contribute to bad credit scores. They are more likely to consider an applicant’s overall financial picture rather than just focusing on their credit history.

Specialized lenders offer a range of debt consolidation options tailored for those with less-than-perfect credit. They may provide unsecured loans, allowing borrowers to consolidate multiple debts without collateral, which is particularly beneficial for the self-employed who might not have assets to pledge as security. These lenders often consider alternative credit references and financial behavior patterns to assess an applicant’s ability to repay, giving a chance to those previously denied traditional loan options.

Strategies to Improve Your Credit Before Applying

Before applying for unsecured consolidation loans, it’s crucial to take proactive steps to improve your credit history, especially if you’re self-employed and may have experienced financial setbacks. One effective strategy is to create a detailed budget that tracks all income and expenses. This provides a clear picture of your financial standing and helps identify areas where adjustments can be made to save money and pay down debt more efficiently.

Additionally, consistently making on-time payments on existing loans and credit cards, even small balances, can significantly boost your credit score over time. If possible, consider paying off high-interest debt first. This reduces the overall interest you’ll accrue in the long run. Remember, demonstrating responsible financial behavior is key to qualifying for Debt Consolidation Loans for the Self Employed with favorable terms.

For individuals with a less-than-perfect credit history, especially those who are self-employed, securing funding can seem daunting. However, debt consolidation loans specifically tailored to meet these needs offer a promising solution. By understanding the benefits and repayment options available, as well as employing strategies to improve one’s creditworthiness, anyone can navigate this process successfully. Remember, with the right approach, achieving financial stability through Debt Consolidation Loans for the Self-Employed is within reach.