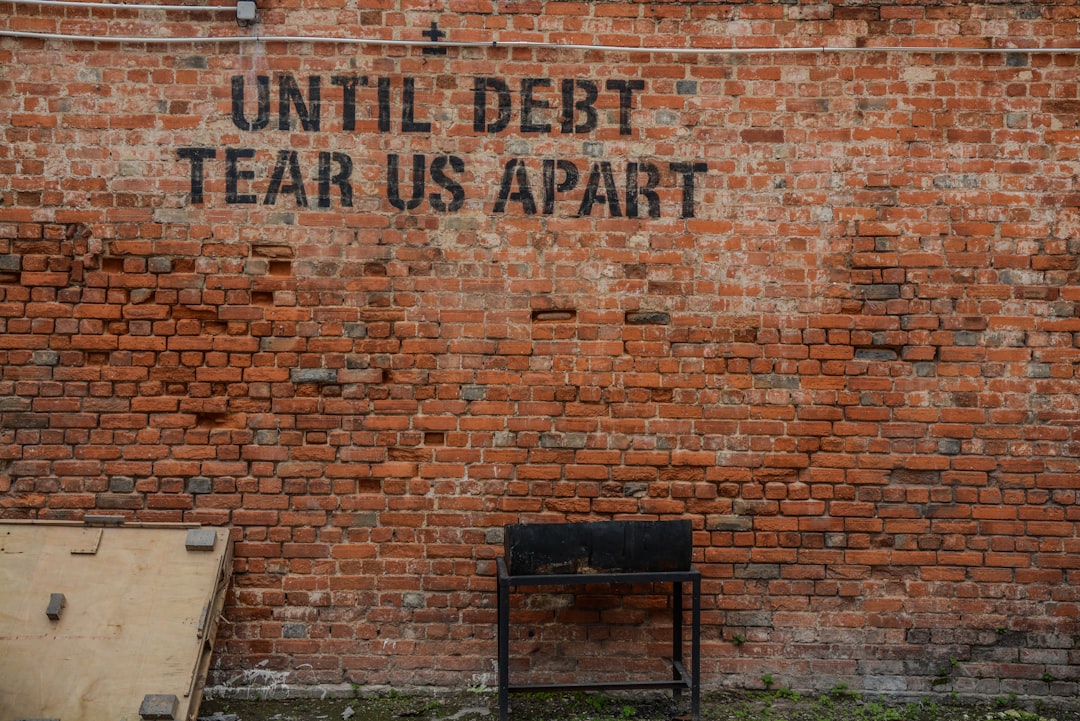

Debt Consolidation Loans for the Self Employed offer a vital safety net during financial hardship, simplifying cash flow by combining multiple debts into one manageable payment. These loans provide lower interest rates and flexible terms, addressing irregular income patterns and promoting long-term debt management. By aligning payments with fluctuating earnings, self-employed individuals gain short-term relief and long-term stability, avoiding default and maintaining financial stability even during unemployment.

Unemployment can pile on debt, leaving self-employed individuals struggling. Debt consolidation loans offer a lifeline with flexible repayment options tailored to their unique circumstances. This article delves into the world of debt consolidation loans for the self-employed, exploring how it alleviates financial stress associated with unemployment. We break down benefits, application processes, and effective post-consolidation strategies, empowering readers with knowledge to make informed decisions about managing debt.

- Understanding Debt Consolidation Loans for Self-Employed Individuals

- Advantages of Consolidating Unemployment Debts

- Exploring Flexible Repayment Plans: Options and Benefits

- Qualifying for Debt Consolidation: Requirements and Criteria

- Navigating the Application Process for Self-Employment Debts

- Effective Strategies to Manage Post-Consolidation Financials

Understanding Debt Consolidation Loans for Self-Employed Individuals

Debt consolidation loans specifically tailored for self-employed individuals offer a much-needed lifeline during financially challenging periods. These loans provide an opportunity to streamline multiple debts into one manageable payment, significantly simplifying cash flow management. For many self-employed folks, this means consolidating high-interest credit card debt, business loans, or even personal loans into a single loan with potentially lower interest rates and more flexible repayment terms.

Such loans are particularly attractive due to their adaptability. Self-employed individuals often have irregular income patterns, making it challenging to adhere to fixed repayment schedules. However, these debt consolidation loans offer options like variable interest rates and customizable repayment plans, allowing borrowers to align payments with their fluctuating earnings. This flexibility not only eases financial pressure but also promotes long-term debt management, ultimately fostering a healthier financial outlook for the self-employed.

Advantages of Consolidating Unemployment Debts

Debt consolidation can be a powerful tool for those facing unemployment and a burden of debt. By combining multiple debts into a single loan with flexible repayment options, individuals can simplify their financial situation and gain better control over their finances. This is especially beneficial for the self-employed or freelancers who may have irregular income and varying business expenses, making it challenging to manage several loans with different terms.

Consolidation allows for more manageable monthly payments tailored to one’s budget, reducing the stress of multiple due dates. It can also free up financial resources that were previously allocated to debt repayment, enabling individuals to focus on job hunting, building a business, or investing in skills and education to secure future employment. This strategic approach to managing debt can be a game-changer for those navigating unemployment, offering both short-term relief and long-term financial stability.

Exploring Flexible Repayment Plans: Options and Benefits

Many individuals, especially those who are self-employed or facing unemployment, often find themselves burdened by multiple debts with limited options to manage them effectively. In such challenging situations, Debt Consolidation Loans for the Self-Employed offer a lifeline. One of the key features these loans provide is flexible repayment plans, tailored to meet borrowers’ unique needs.

These flexible options allow debtors to distribute their loan repayments over an extended period, making the burden more manageable. Unlike strict payment schedules, these plans enable individuals to adjust their payments based on fluctuating income levels or unforeseen circumstances, such as periods of unemployment. By spreading out the debt, borrowers can avoid defaulting on loans and maintain a healthier financial standing in the long term.

Qualifying for Debt Consolidation: Requirements and Criteria

Debt consolidation loans are a popular choice for individuals seeking financial relief, especially those who are self-employed and dealing with unemployment. While traditional loan options may be stringent, debt consolidation loans cater to the unique needs of the self-employed by offering flexible repayment terms. To qualify, borrowers must demonstrate a steady income stream, despite their employment status, and provide proof of identity and residency. Lenders assess overall financial health, including credit history, to determine loan eligibility and set interest rates.

Self-employed individuals can leverage business revenue, tax returns, and bank statements to meet these requirements. It’s beneficial for those managing multiple debts with varying interest rates as consolidation simplifies repayment by combining them into one loan with a potentially lower, fixed rate. This approach can help free up cash flow, making it easier to navigate financial challenges brought on by unemployment.

Navigating the Application Process for Self-Employment Debts

Navigating the application process for debt consolidation loans can be challenging, especially for those who are self-employed. Lenders often require detailed financial documentation to assess income stability and eligibility. For self-employed individuals, this may involve providing tax returns, business financial statements, and other relevant records to demonstrate their financial situation.

Debt consolidation loans tailored for the self-employed offer flexible repayment options, allowing borrowers to align payments with seasonal income fluctuations. These loans can help streamline multiple debts into a single, manageable payment, alleviating stress and potentially saving money on interest. Lenders may also be more understanding of varying income patterns, making it easier for self-employed individuals to gain access to the financial support they need.

Effective Strategies to Manage Post-Consolidation Financials

Managing your finances after securing a debt consolidation loan is a strategic process, especially for those in the self-employed sector. One effective strategy involves creating a detailed budget that accounts for all income sources and loan repayment obligations. By categorizing expenses and allocating funds responsibly, individuals can ensure they stay on track with their consolidated loan repayments while covering daily living costs.

Additionally, building an emergency fund is a wise move to prevent future financial strain. This safety net provides a buffer against unexpected expenses, reducing the risk of defaulting on loan payments or relying on high-interest credit options. For self-employed individuals, this might involve setting aside a percentage of their income each month into a dedicated savings account, ensuring they have the flexibility to manage cash flow fluctuations while maintaining loan repayment discipline.

Debt Consolidation Loans for the self-employed offer a viable solution to manage and reduce unemployment-related debts, especially with flexible repayment options. By consolidating multiple loans, individuals can simplify their financial obligations, lower interest rates, and regain control of their finances. This article has provided an overview of the benefits, application process, and post-consolidation strategies, empowering self-employed individuals to make informed decisions regarding their debt management journey.