Self-employed individuals facing unemployment and high debts can find relief with Debt Consolidation Loans for the Self Employed, which combine multiple debts into one manageable payment with lower interest rates. These loans offer flexible terms tailored to irregular incomes, allowing for better cash flow management during financial transitions. By streamlining debt obligations, these loans enable individuals to focus on career development or building an emergency fund, ultimately achieving long-term financial stability. Securing these loans requires maintaining a strong credit profile and providing detailed financial statements.

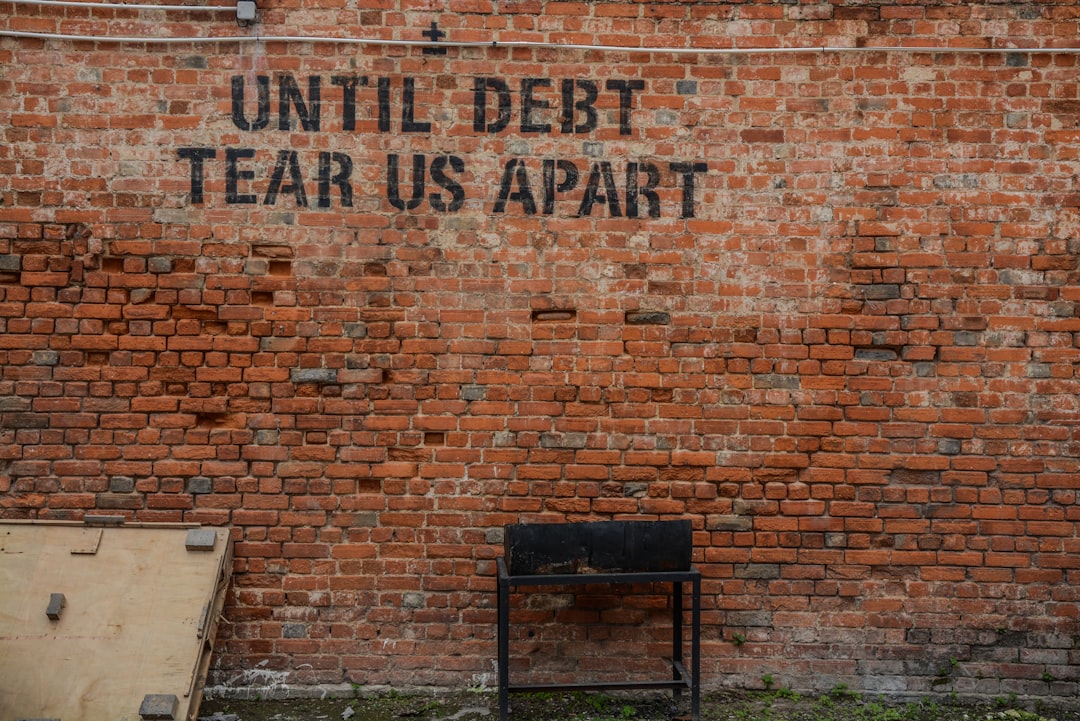

Unemployment can exacerbate financial strain, with mounting bills and loans creating a seemingly insurmountable burden. This is where debt consolidation loans for the self-employed offer a lifeline. Designed to streamline repayment and reduce stress, these specialized loans provide a strategic approach to managing debts. This article delves into the intricacies of these loans, highlighting their advantages for unemployed professionals seeking financial respite and offering practical strategies for securing them.

- Understanding Debt Consolidation Loans for Self-Employed Individuals

- Advantages of Consolidating Bills and Loans for Unemployed Professionals

- Effective Strategies for Securing Debt Consolidation Personal Loans

Understanding Debt Consolidation Loans for Self-Employed Individuals

For self-employed individuals grappling with unemployment and a mountain of debts, debt consolidation loans can offer a lifeline. These specialized loans are tailored to meet the unique financial needs of freelancers and entrepreneurs, allowing them to streamline multiple outstanding debts into a single, more manageable payment. By consolidating debt, self-employed borrowers can reduce their interest rates, ease cash flow pressures, and potentially free up time for business growth or job hunting.

Debt consolidation loans for the self-employed often come with flexible terms and conditions, taking into account the irregular income patterns typical of this demographic. Lenders understand that financial security fluctuates, so they offer repayment plans that adapt to evolving circumstances. This can be particularly beneficial during periods of unemployment when a fixed repayment schedule might otherwise prove challenging.

Advantages of Consolidating Bills and Loans for Unemployed Professionals

For unemployed professionals, managing debt can feel like a daunting task. However, consolidating bills and loans through debt consolidation loans for the self-employed offers several key advantages that can help turn this challenge into an opportunity for financial recovery. Firstly, it simplifies the repayment process by combining multiple debts into a single loan with a potentially lower interest rate, making payments more manageable. This is particularly beneficial during periods of unemployment when cash flow is limited.

Additionally, debt consolidation can provide much-needed breathing room by extending the repayment term, which reduces monthly payments and eases financial strain. It also allows individuals to focus on securing a stable income or exploring employment opportunities without the constant pressure of diverse debt obligations. By streamlining debts, professionals can better allocate resources towards career development or building an emergency fund, ultimately paving the way for long-term financial stability.

Effective Strategies for Securing Debt Consolidation Personal Loans

When it comes to securing debt consolidation personal loans, especially as a self-employed individual, there are several effective strategies to consider. Firstly, build and maintain a strong credit profile. Lenders will want to see evidence of responsible borrowing and timely repayments. This can be achieved by keeping credit card balances low, making payments on time, and regularly reviewing your credit report for any errors or discrepancies.

Additionally, prepare detailed financial statements. As a self-employed borrower, lenders will require proof of income and business stability. Provide tax returns, bank statements, and any other relevant financial documents to demonstrate your ability to repay the loan. Clearly outline your monthly cash flow, expenses, and debt obligations to give lenders a comprehensive view of your financial situation.

Debt Consolidation Loans for the Self-Employed offer a viable solution for those navigating unemployment and multiple debt obligations. By consolidating bills and loans, professionals can simplify their financial situation, reduce interest rates, and gain better control over their finances. With strategic planning and careful consideration, individuals can secure these loans to streamline repayment, ultimately leading to financial stability and a fresh start.