Debt Consolidation Loans for Self-Employed offer a solution for managing finances by combining multiple high-interest debts into one loan with flexible terms. Lenders assess financial health, income stability, and debt type for approval, focusing on credit history (min 550), income proof, and debt-to-income ratio. Loan amounts range from $ few hundred to several thousand, with repayment terms from 12-60 months, tailored to individual needs and cash flow.

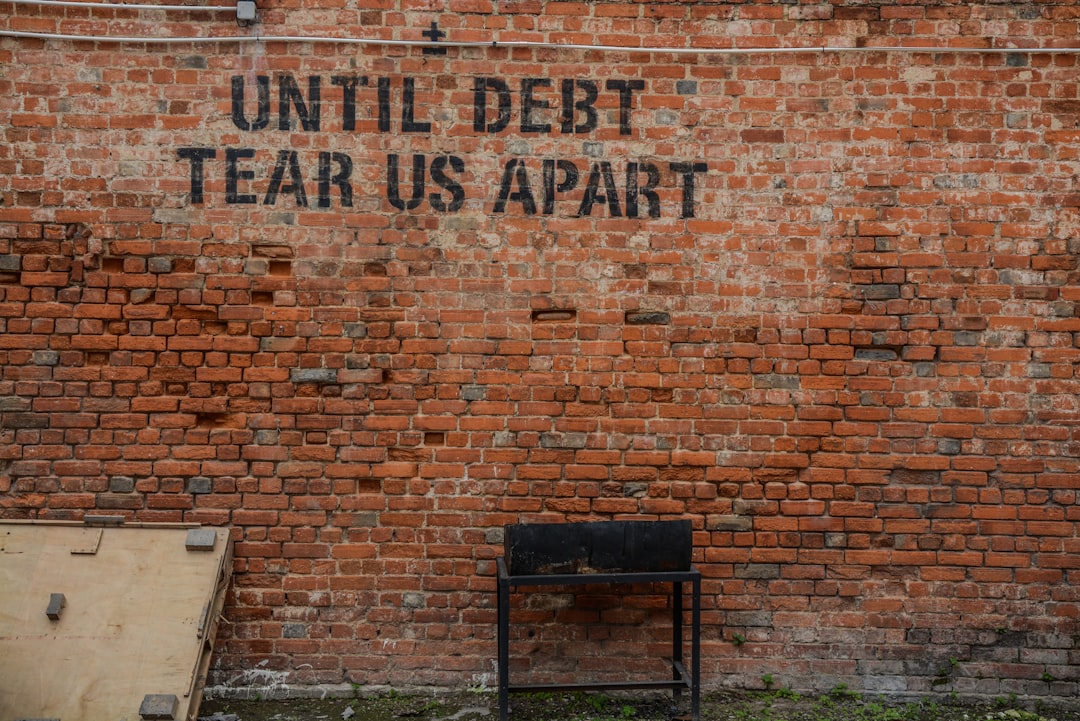

Struggling with debt as a self-employed individual? Debt consolidation loans could be a solution, but understanding the eligibility criteria is crucial. This guide breaks down the key factors for self-employed borrowers with bad credit looking to consolidate their debts. From income requirements and employment stability to loan amounts and repayment terms, we’ll navigate the landscape of debt consolidation loans specifically tailored for the self-employed, empowering you to make an informed decision.

- Understanding Debt Consolidation Loans for Self-Employed

- Criteria for Bad Credit Applicants: Key Factors

- The Role of Income and Employment Status

- Loan Amounts and Repayment Terms Explained

Understanding Debt Consolidation Loans for Self-Employed

Debt consolidation loans for self-employed individuals offer a unique opportunity to streamline financial obligations and gain control over their finances. These loans are specifically tailored to cater to the needs of freelancers, contractors, and small business owners who often face challenges in accessing traditional financing options due to the irregular nature of their income streams.

Self-employed individuals can use debt consolidation loans to combine multiple high-interest debts into a single, more manageable repayment. This strategy simplifies financial management by reducing the number of payments required each month, thereby saving time and potentially lowering overall interest expenses. Moreover, these loans often provide flexible terms, allowing self-employed borrowers to align repayment schedules with their fluctuating cash flow patterns, making them an attractive solution for those seeking financial stability amidst economic uncertainty.

Criteria for Bad Credit Applicants: Key Factors

When it comes to debt consolidation loans for individuals with bad credit, several key factors come into play for lenders when evaluating applicants. These criteria are essential in determining the borrower’s ability to repay and manage a new loan while improving their financial health. Firstly, lenders will assess the applicant’s credit history, which is typically reflected in their credit score. A low or poor credit score indicates higher risk, so lenders may require a minimum credit score of 550 or higher for approval. This score is often a deciding factor, especially for those seeking Debt Consolidation Loans for the Self-Employed, as it showcases financial responsibility and predictability.

Additionally, lenders will consider the applicant’s income stability and debt-to-income ratio. For self-employed individuals, providing verifiable income documents and a stable revenue stream is crucial. Lenders want to ensure that the borrower has a consistent ability to make loan payments. Another significant factor is the type of debts the individual carries. Consolidation loans are often more accessible for those with unsecured debts, such as credit cards or personal loans, compared to those with complex business or investment-related debt structures. These criteria help lenders assess the risk associated with extending Debt Consolidation Loans for the Self-Employed and other applicants facing bad credit challenges.

The Role of Income and Employment Status

When considering a debt consolidation loan, lenders will closely examine an applicant’s income and employment status to ensure they can repay the loan. For individuals who are self-employed, demonstrating consistent and stable income is crucial for approval. Lenders often require financial statements, tax returns, or business records to assess the borrower’s financial health and ability to make regular payments.

Income stability is a key factor in securing a debt consolidation loan, as it indicates the borrower’s capacity to manage repayment obligations alongside their daily expenses. Self-employed individuals may face unique challenges in this regard, but by presenting detailed financial documentation, they can increase their chances of approval for Debt Consolidation Loans for the Self Employed and work towards improving their overall financial situation.

Loan Amounts and Repayment Terms Explained

When considering Debt Consolidation Loans for the Self-Employed, understanding loan amounts and repayment terms is crucial. Lenders typically offer loans ranging from a few hundred to several thousand dollars, depending on the borrower’s financial situation and the extent of their debt. This flexibility allows self-employed individuals to tailor their loan to cover specific expenses or consolidate multiple debts into one manageable payment.

Repayment terms vary widely, with lenders providing options from short-term (e.g., 12-24 months) to long-term (up to 60 months) plans. Self-employed borrowers should consider their cash flow and ability to make consistent payments when selecting a term that aligns with their financial goals and capability. Proper planning ensures they can effectively manage their debt while maintaining business stability.

Debt consolidation loans can be a viable option for self-employed individuals with bad credit, offering a chance to streamline multiple debts into one manageable repayment. By understanding the eligibility criteria, including income requirements and loan terms, borrowers can make informed decisions. For those who meet the key factors, these loans provide an opportunity to rebuild financial stability and navigate their financial future with confidence.